When it comes to risk, you want to work with a professional.

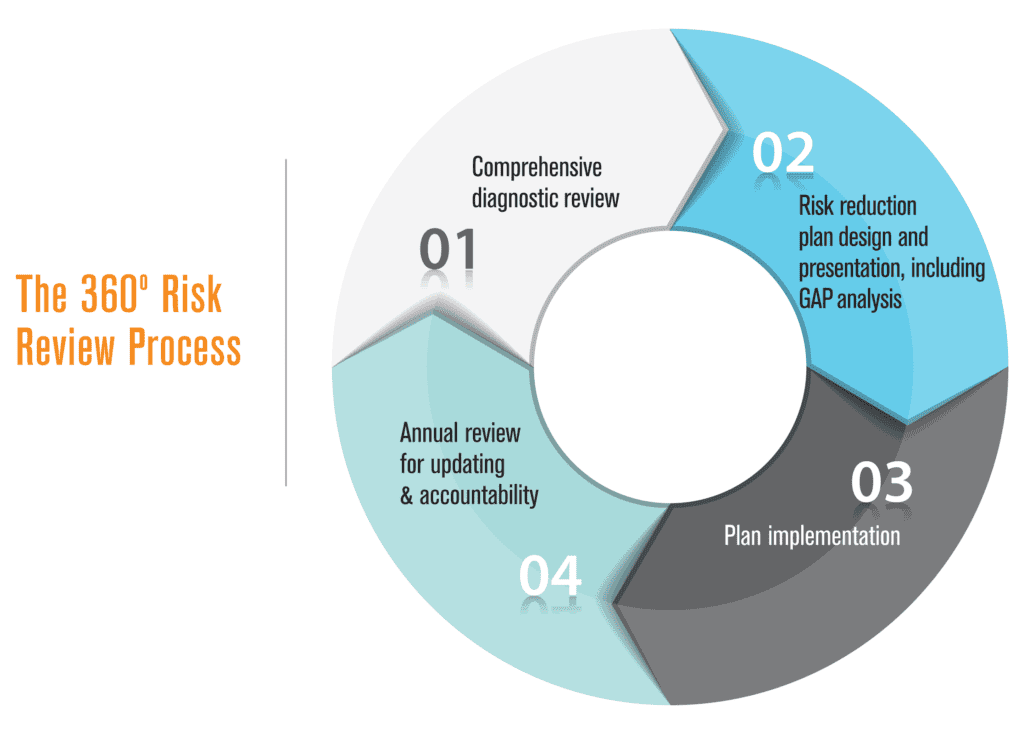

DII is an expert partner with a half century of experience helping clients manage their Total Cost of Risk (TCOR). Our proprietary 360°Degree Risk Review™ process helps businesses reach these goals:

- Lower Total Cost of Risk

- Hard & Soft Cost Savings related to Risk

- Make our clients attractive to the insurance marketplace to earn better rates and lock in best in category class of risk coverage

We provide a clear and beneficial match between our clients’ needs, their risk management choices and their insurance coverage.

While others deliver proposals, we deliver plans – plans that reduce uncertainty and increase your ability to compete.

DII crafts custom risk reduction plans based on a comprehensive review of your business assets and risks measured against short and long-term goals. Among many considerations that influence your business, we consider the legal and regulatory environment in which you operate. Our 360° Risk Reduction Plan™ establishes priorities that will lead to results. Our proactive plan identifies and corrects any vulnerabilities that may exist. Along the way, we become your partner in improvement and increase the likelihood that key strategies will be implemented. Like a personal trainer for your risk strategies, we will make sure the work gets done.

Unlike many in our industry, we hold ourselves accountable to results. On an annual basis, we review the promises made and reflect on progress. Our definition of our core value of integrity requires a one-to-one relationship between promises made and promises kept. With over 50 years of history as evidence, we will keep our word.

In support of our plans, we have a robust toolkit that we provide to our clients, which includes:

- Safety Committee formation and managing to help you grow your safety team as a loss prevention strategy

- Onsite safety consultants to train your leaders and validate your efforts

- Safety training tracts for Employees, with over 50 tracts that cover a wide variety of activities such as employee fall protection, confined spaces training, distance driving, and more

- Tracking incidents and monitoring recovery

- Contract review/Exposure compliance

- Reviewing out of compliance insurance

- Cyber Threat Detection and ongoing monitoring

- Vendor Management

- Subcontractor Engagement and Compliance

- Accident Investigation and Review

- Regular Loss Review and After Action Reviews

- Cause of loss trending

- Actions Plans based on results

Telephone No.(888) 433-3553